All Categories

Featured

Table of Contents

There is no one-size-fits-all when it comes to life insurance./ wp-end-tag > In your busy life, monetary self-reliance can appear like an impossible goal.

Pension plan, social safety, and whatever they 'd taken care of to conserve. Yet it's not that easy today. Fewer companies are supplying standard pension plan plans and several companies have reduced or stopped their retired life plans and your ability to rely solely on social safety and security is in inquiry. Also if benefits haven't been reduced by the time you retire, social protection alone was never ever intended to be enough to spend for the way of life you want and are worthy of.

Currently, that might not be you. And it's important to understand that indexed global life has a whole lot to offer individuals in their 40s, 50s and older ages, along with people that desire to retire early. We can craft a service that fits your particular circumstance. [video: An illustration of a man appears and his wife and child join them.

This is replaced by an illustration of a document that reads "IUL POLICY - $400,000". The document hovers along a dotted line passing $6,000 increments as it nears an illustrated bubble labeled "age 70".] Now, expect this 35-year-old guy needs life insurance to protect his household and a means to supplement his retired life revenue. By age 90, he'll have received almost$900,000 in tax-free revenue. [video: Text boxes appear that read "$400,000 or more of protection" and "tax-free income through policy loans and withdrawals".] And needs to he die around this time around, he'll leave his survivors with even more than$400,000 in tax-free life insurance policy advantages.< map wp-tag-video: Text boxes appear that read"$400,000 or even more of protection"and "tax-free income with policy car loans and withdrawals"./ wp-end-tag > As a matter of fact, throughout every one of the accumulation and disbursement years, he'll obtain:$400,000 or even more of security for his heirsAnd the opportunity to take tax-free earnings through plan financings and withdrawals You're most likely questioning: How is this possible? And the answer is simple. Rate of interest is tied to the efficiency of an index in the stock market, like the S&P 500. But the cash is not straight invested in the securities market. Interest is attributed on an annual point-to-point segments. It can offer you extra control, flexibility, and options for your monetary future. Like many individuals today, you might have accessibility to a 401(k) or various other retired life strategy. Which's a terrific initial step towards conserving for your future. Nonetheless, it's crucial to understand there are limitations with certified plans, like 401(k)s.

Universal Life Company

And there are constraints on when you can access your money without fines. [video: Text boxes appear that read "limits on contributions", "restrictions when accessing money", and "money can be taxable".] And when you do take cash out of a qualified plan, the cash can be taxed to you as revenue. There's an excellent reason many individuals are turning to this one-of-a-kind solution to resolve their financial objectives. And you owe it to yourself to see how this can help your very own personal scenario. As part of an audio financial technique, an indexed global life insurance policy plan can help

What Is Guaranteed Universal Life

you handle whatever the future brings. And it supplies distinct capacity for you to build substantial cash value you can use as additional income when you retire. Your money can expand tax delayed with the years. And when the plan is designed appropriately, circulations and the death benefit will not be tired. [video: Text box appears that reads "contact your United of Omaha Life Insurance company agent/producer today".] It is essential to speak with a specialist agent/producer that comprehends just how to structure an option such as this appropriately. Before dedicating to indexed global life insurance policy, below are some pros and cons to consider. If you pick an excellent indexed universal life insurance policy strategy, you may see your cash money worth grow in worth. This is practical because you may have the ability to gain access to this cash prior to the plan runs out.

Tax Free Retirement Iul

If you can access it at an early stage, it may be beneficial to factor it into your. Considering that indexed global life insurance policy calls for a specific level of danger, insurance coverage firms tend to keep 6. This sort of plan likewise provides (buy universal life insurance). It is still ensured, and you can change the face amount and riders over time7.

Commonly, the insurance firm has a vested rate of interest in performing better than the index11. These are all factors to be considered when picking the finest kind of life insurance policy for you.

Fixed Universal Life

Nevertheless, because this kind of plan is much more complicated and has a financial investment part, it can often come with greater premiums than other policies like whole life or term life insurance. If you don't believe indexed universal life insurance policy is right for you, right here are some alternatives to take into consideration: Term life insurance policy is a short-term plan that usually uses insurance coverage for 10 to 30 years.

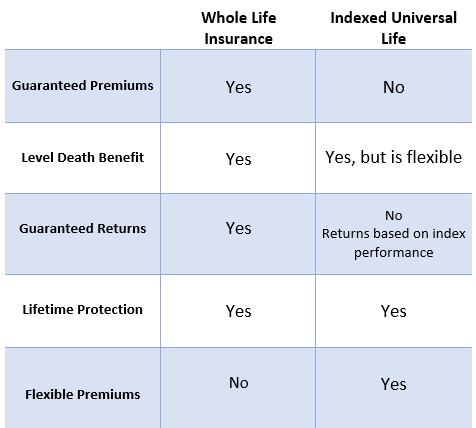

When choosing whether indexed universal life insurance policy is right for you, it's essential to consider all your options. Whole life insurance policy may be a much better choice if you are trying to find even more stability and uniformity. On the various other hand, term life insurance coverage might be a better fit if you only need insurance coverage for a specific time period. Indexed global life insurance policy is a sort of policy that provides extra control and adaptability, together with higher money worth growth capacity. While we do not use indexed universal life insurance policy, we can provide you with even more details about entire and term life insurance policy policies. We suggest discovering all your options and talking with an Aflac representative to uncover the very best fit for you and your family members.

The rest is included in the money value of the policy after costs are subtracted. The money value is credited on a month-to-month or yearly basis with interest based on increases in an equity index. While IUL insurance policy may confirm useful to some, it is essential to recognize how it works prior to buying a plan.

Latest Posts

Online Universal Life Insurance Quotes

Veterans Universal Life Insurance

Best Universal Life